IRS Publication 15-B provides employers with a comprehensive guide to understanding and managing fringe benefits, ensuring compliance with tax regulations and proper reporting requirements․

1․1 Overview of the Employers Tax Guide to Fringe Benefits

IRS Publication 15-B serves as a detailed guide for employers, explaining the tax treatment of fringe benefits․ It covers various benefits, such as health plans, tuition reimbursement, and gym memberships, while providing valuation methods and reporting requirements․ The guide also highlights updates for 2024 and ensures compliance with IRS regulations, helping employers understand taxable and non-taxable benefits to avoid legal issues and attract employees effectively․

1․2 Purpose and Scope of Publication 15-B

Publication 15-B aims to assist employers in understanding the tax implications of fringe benefits, ensuring accurate reporting and compliance․ It outlines the scope, covering various benefits like health plans, tuition reimbursement, and gym memberships, while detailing valuation methods and documentation requirements․ The guide also provides updates for 2024, helping employers navigate complexities and maintain adherence to IRS regulations effectively․

Understanding Fringe Benefits

Fringe benefits are non-wage compensation provided to employees, such as health insurance, retirement plans, or gym memberships, which can be taxable or non-taxable depending on IRS rules․

2․1 Definition and Examples of Fringe Benefits

Fringe benefits are non-wage compensation provided by employers, such as health insurance, retirement plans, tuition reimbursement, and gym memberships․ They can be taxable or non-taxable, depending on IRS guidelines, and include both monetary and non-monetary perks to employees, enhancing their overall compensation package beyond salary․

2․2 Taxable vs․ Non-Taxable Fringe Benefits

Taxable fringe benefits are those included in an employee’s income, such as cash bonuses or personal use of company vehicles․ Non-taxable benefits, like health insurance or qualified retirement plans, are exempt from income and payroll taxes․ The distinction is crucial for accurate tax reporting and compliance with IRS regulations, as outlined in Publication 15-B․

The Purpose of Publication 15-B

Publication 15-B guides employers on fringe benefits taxation, ensuring compliance with IRS rules and providing updates to help businesses accurately report and manage fringe benefit-related taxes effectively․

3․1 Guidance for Employers on Fringe Benefits Taxation

Publication 15-B offers detailed guidance on taxing fringe benefits, helping employers determine which benefits are taxable or exempt, and how to properly value and report them to the IRS, ensuring compliance with current tax laws and regulations for accurate financial reporting and employee compensation management․

3․2 Key Updates and Changes in the 2024 Edition

The 2024 edition of Publication 15-B includes updates on fringe benefit valuation methods, revised mileage reimbursement rates, and clarified guidelines for gym memberships and wellness programs․ It also addresses legislative changes affecting tax-exempt benefits, ensuring employers stay compliant with the latest IRS regulations and reporting requirements for the 2024 tax year․

Types of Fringe Benefits

IRS Publication 15-B explains that fringe benefits include both taxable and non-taxable items, such as health insurance, retirement plans, and gym memberships, with specific tax rules applied․

4․1 Taxable Fringe Benefits

Taxable fringe benefits are benefits provided by employers that must be included in an employee’s taxable income․ Examples include gym memberships, certain meals, and personal use of company vehicles․ These benefits are subject to federal income tax withholding, Social Security, and Medicare taxes․ The value of taxable fringe benefits is typically determined by their fair market value, ensuring proper tax treatment under IRS guidelines․

4․2 Non-Taxable Fringe Benefits

Non-taxable fringe benefits are excluded from an employee’s taxable income under specific IRS conditions․ Examples include health insurance premiums, meals provided for business purposes, and qualified educational assistance․ These benefits are not subject to federal income tax withholding or employment taxes, offering tax advantages to both employers and employees while adhering to IRS regulations․

Valuation of Fringe Benefits

Valuation of fringe benefits involves determining their fair market value (FMV) or using specific IRS methods to calculate taxable amounts accurately for reporting purposes․

5․1 Fair Market Value (FMV) and Its Calculation

Fair Market Value (FMV) is the price an asset would sell for in a fair and open market․ For fringe benefits, FMV determines the taxable amount․ Employers calculate FMV using IRS-approved methods, such as appraisals or standard mileage rates․ Accurate valuation ensures proper tax reporting and compliance with IRS guidelines, avoiding potential penalties․ FMV is crucial for benefits like company vehicles, housing, or personal use of business property․

5․2 Special Valuation Rules for Specific Benefits

Certain fringe benefits have unique valuation rules․ For example, employer-provided vehicles are valued using the IRS mileage rate or lease chart․ Group-term life insurance over $50,000 is taxed based on the cost of coverage․ Meals and lodging are valued at their fair market value unless provided on the employer’s premises․ These specific rules ensure accurate tax treatment and compliance with IRS guidelines for various fringe benefits․

Tax Implications for Employers

Employers must include taxable fringe benefits in employees’ income, subjecting them to payroll taxes․ Non-taxable benefits may still impact employer tax obligations and deductions․

6․1 Employment Tax Treatment of Fringe Benefits

The employment tax treatment of fringe benefits depends on their taxability․ Taxable benefits, such as cash and certain non-cash perks, are included in employees’ wages and subject to payroll taxes․ Non-taxable benefits, like qualified health plans, are exempt from income and employment taxes․ Employers must accurately determine the tax status of each benefit to ensure compliance with IRS regulations and avoid penalties․

6․2 Deductibility of Fringe Benefits as Business Expenses

Fringe benefits are generally deductible as business expenses if they meet IRS requirements․ Employers can deduct the cost of providing tax-free fringe benefits, such as health insurance and educational assistance, as ordinary business expenses․ Taxable fringe benefits are also deductible, provided they are included in the employee’s taxable income․ Compliance with IRS guidelines ensures proper expense reporting and tax savings for employers․

Reporting Fringe Benefits

Employers must accurately report fringe benefits on appropriate tax forms, ensuring compliance with IRS guidelines and deadlines to avoid penalties and maintain proper tax records․

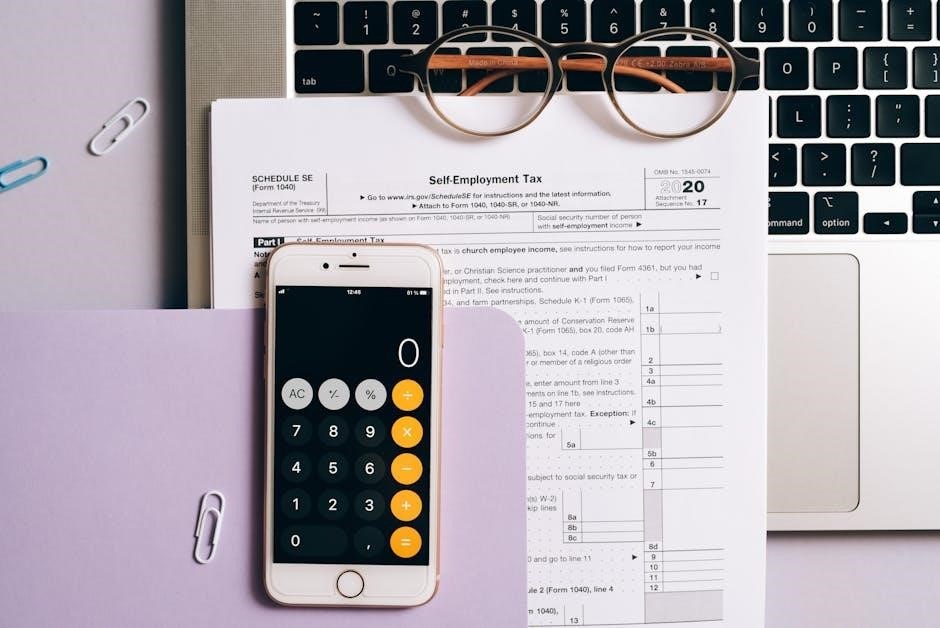

7․1 Forms and Documentation Requirements

Employers must use specific IRS forms, such as Form W-2 and Form 941, to report fringe benefits․ Accurate documentation, including records of benefits provided and their fair market value, is essential․ Employers must retain detailed records for audit purposes and ensure compliance with IRS guidelines to avoid penalties․ Proper documentation also includes proof of employee eligibility for tax-free benefits, as outlined in Publication 15-B․

7․2 IRS Reporting Deadlines and Compliance

Employers must adhere to strict IRS reporting deadlines for fringe benefits․ Form W-2 must be filed by January 31st annually, reflecting taxable fringe benefits․ Form 941 is due quarterly to report employment taxes․ Compliance with these deadlines ensures avoidance of penalties and maintains regulatory adherence․ Publication 15-B emphasizes timely submission and accuracy in reporting to uphold tax compliance standards effectively for all fringe benefit-related filings․

IRS Guidance on Specific Fringe Benefits

Publication 15-B offers detailed guidance on specific fringe benefits, including accident and health benefits, tuition reimbursement, and gym memberships, outlining their tax treatment and compliance requirements․

8․1 Accident and Health Benefits

Accident and health benefits are addressed in Publication 15-B, providing clarity on their tax treatment․ Employers can exclude contributions to these plans from employees’ taxable income if specific IRS criteria are met․ For example, health insurance premiums and medical expense reimbursements are generally tax-exempt under Section 105․ This section helps employers navigate the rules to ensure compliance and proper reporting of these benefits․

8․2 Tuition Reimbursement and Educational Assistance

Publication 15-B clarifies that tuition reimbursement and educational assistance are tax-free up to $5,250 annually under Section 127․ Employers can deduct these expenses as business costs, while employees exclude them from taxable income․ However, benefits exceeding $5,250 or used for non-degree programs may be taxable․ This section provides guidelines to ensure compliance with IRS rules for educational fringe benefits․

Special Cases and Exceptions

Publication 15-B addresses unique situations, such as gym memberships and wellness programs, providing guidance on their tax treatment and exceptions to standard fringe benefit rules․

9․1 Fringe Benefits for Non-Employees

Fringe benefits for non-employees, such as independent contractors, are generally not subject to employment taxes․ However, their tax treatment depends on the recipient’s relationship to the employer and the type of benefit provided․ For example, accident and health benefits for non-employees may be tax-exempt under specific conditions․ Employers must document these benefits carefully to ensure compliance with IRS guidelines and avoid potential tax liabilities․

9․2 Gym Memberships and Wellness Programs

Gym memberships and wellness programs provided by employers can be nontaxable if certain conditions are met, such as being on-premises and available to all employees․ Off-site gym memberships may be taxable unless specific IRS conditions are satisfied․ Employers can deduct these expenses as business overhead, but the tax treatment varies for employees and independent contractors․ Compliance with IRS guidelines is essential to avoid tax issues․

Recent Updates and Changes

The 2024 edition of Publication 15-B includes updated guidance on fringe benefits, such as changes to business mileage rates and clarification on taxable benefits, effective January 1, 2025․

10․1 2024 Updates to Fringe Benefits Taxation

The 2024 updates to Publication 15-B introduced revised rules on fringe benefits, including changes to business mileage rates, clarifications on taxable benefits, and new guidelines for employer-sponsored wellness programs․ These updates aim to reflect current tax laws and provide employers with clear guidance on compliance, ensuring accurate reporting and minimizing potential penalties․ Employers are encouraged to review these changes to stay informed and adapt their benefit strategies accordingly․

10․2 Impact of Legislative Changes on Fringe Benefits

Legislative changes, such as updates to tax laws, significantly impact fringe benefits by altering their tax treatment․ For example, revisions to tuition reimbursement rules now allow tax-free benefits up to $5,250 annually, while gym memberships remain non-taxable under specific conditions․ Employers must stay informed about these changes to ensure compliance and accurately reflect updates in their benefit offerings and reporting practices to avoid penalties and maintain tax efficiency․

Best Practices for Employers

Employers should consult tax professionals, conduct regular audits, and communicate clearly with employees to ensure compliance and maximize the benefits of fringe benefits tax strategies effectively․

11․1 Implementing Fringe Benefits Effectively

Employers should design fringe benefits aligned with organizational goals and employee needs․ Clear communication ensures transparency, while regular reviews maintain compliance․ Tailoring benefits enhances employee satisfaction and retention rates significantly․

11․2 Avoiding Common Pitfalls in Fringe Benefits Taxation

Employers must accurately classify benefits as taxable or non-taxable, adhering to IRS guidelines․ Proper documentation and timely reporting are crucial to avoid penalties․ Regular audits ensure compliance, and staying informed about updates helps mitigate risks effectively․

IRS Publication 15-B serves as a vital guide for employers to navigate fringe benefits taxation, ensuring compliance and accurate reporting while staying informed on IRS updates and requirements․

12․1 Summary of Key Points

IRS Publication 15-B offers a detailed guide for employers on fringe benefits, outlining taxable and non-taxable benefits, valuation methods, reporting requirements, and recent updates․ It ensures employers understand compliance with IRS guidelines, providing clarity on how to manage and report fringe benefits accurately while staying informed about legislative changes impacting tax treatments․

12․2 Importance of Compliance with IRS Guidelines

Compliance with IRS guidelines is crucial to avoid penalties, ensuring accurate reporting and proper tax treatment of fringe benefits․ Employers must differentiate between taxable and non-taxable benefits, adhere to valuation rules, and follow documentation requirements․ Non-compliance can lead to audits, fines, and reputational damage, emphasizing the need for strict adherence to IRS Publication 15-B directives to maintain legal and financial integrity․